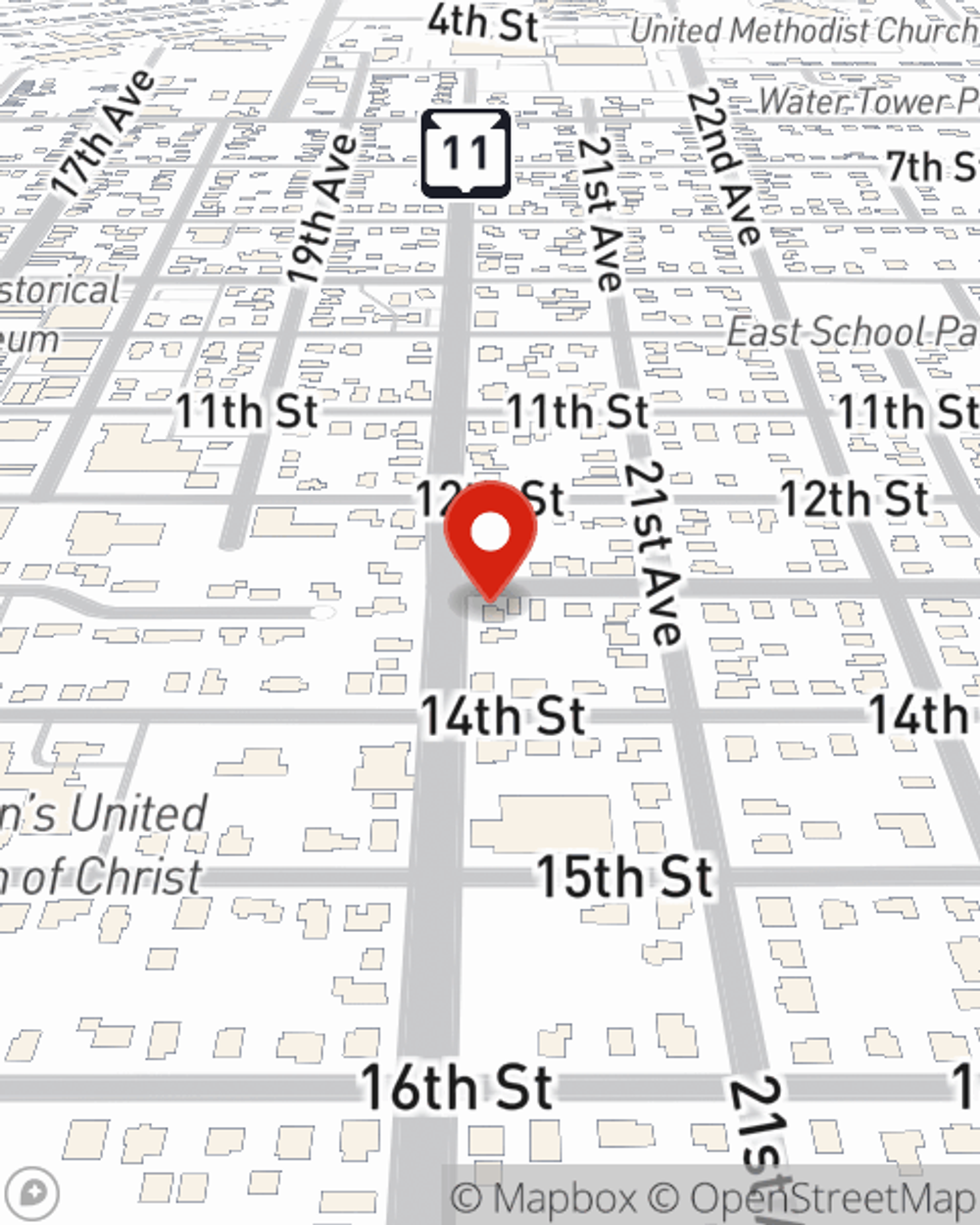

Business Insurance in and around Monroe

Looking for small business insurance coverage?

Cover all the bases for your small business

- Monroe

- Juda

- Brodhead

- Browntown

- New Glarus

- Monticello

- Gratiat

- Albany

- Evansville

- South Wayne

- Argyle

Insure The Business You've Built.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all on your own. State Farm agent Jake Dillenburg, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Business With State Farm

For your small business, whether it's an ice cream shop, a vet hospital, a home cleaning service, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, business property, and accounts receivable.

At State Farm agent Jake Dillenburg's office, it's our business to help insure yours. Get in touch with our outstanding team to get started today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jake Dillenburg

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.